Easy Inventions to Make in Financial Literacy Class in Warren Middle School

Money, and knowing how to make, save, and spend it, is an important lesson in becoming an independent adult. Kids can begin learning basic financial literacy skills from a very young age.

The basic concept of trade, making connections between money and things you want, is an easy first step to financial understanding and money management.

Whether you teach a personal finance class or just want to include some money-conscious activities into your curriculum, we have 20 ideas perfect for your middle school classroom!

1. Misadventures in Money Management

This game interface has the look and appeal of a graphic novel, but plays just like an action video game! Your middle schoolers can fight bad guys, win challenges, and work together with other players to learn how to make wise financial decisions.

Learn more: Misadventures in Money Management

2. "Price is Right!"

Have your students get a piece of paper and write down all the things they buy in a month. Then ask them to guess the total amount of their expenses without looking up prices or asking someone else. The student that gets the closest to their actual amount wins a prize.

Learn more: Metro Parent

3. Monopoly Life Lessons

There are some useful financial concepts used in the board game "Monopoly" that you can use as a way to teach your students about making sound decisions in regard to investments and purchases.

Learn more: Minnesota Public Radio News

4. Minimum Wage Budget

Depending on where your school is located, your minimum wage is set and governed by the state. So look up the minimum wage in your area and ask your students to get into groups and plan a yearly budget based on a minimum wage salary.

Learn more: Crafty Teacher Lady

5. Consumer Savings Activity

There are many ways we can save money on things we buy every day. This lesson plan asks each student to research a few different ways and create an interactive flyer to post in the classroom. Once everyone's flyers are prepared and embedded with a QR code, students can take a tour around and learn what their classmates can teach them.

Learn more: Consumer Savings Flyer

6. Name Brand vs. Store Brand

/cloudfront-us-east-1.images.arcpublishing.com/gray/DACNU56JHFFLNLEIBK54N6AB2U.jpg)

Now, this can be a really fun and hands-on activity if you are able to find some products to bring to class. Food items will be the best examples to use for a blind-tasting experiment. Have the name brand and store brand foods in unmarked containers for students to try and see who can guess which is which.

Learn more: Name Brand versus Store Brand: Is it Worth the Extra Cost?

7. The Ramsey Show

This web channel has tons of short and informative video clips that ask financial questions many young adults have themselves. Ask your students to pick a few videos to watch and discuss as a class to learn what they can do when certain unexpected events happen.

Learn more: The Ramsey Show - Highlights

8. Analyzing Articles

There are plenty of informative articles out there that break down career planning, debt management, and budgeting skills in a way readers with no financial knowledge can follow. Assign an article to a group of students and ask them to find and write down 5 key concepts they found most useful to share with the class.

Learn more: Investopedia

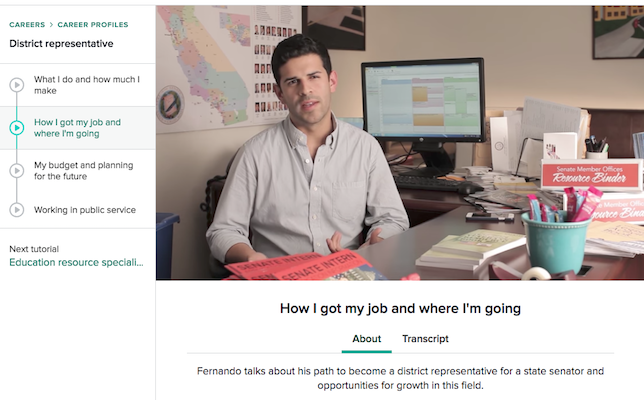

9. Khan Academy

This free education resource has information on many topics regarding personal finances. You can browse through the website with your class to give them a chance to see what is available and pick topics they find interesting to go through in further detail.

Learn more: Khan Academy

10. Comparison Shopping

Seeing what options there are, checking/matching prizes, and testing the quality of products are all important aspects of comparison shopping. Being smart with finances can start each time your students go to the store. Ask them to compare prices between 2-3 items before making purchases.

Learn more: Study Money

11. Stocks and Investment Online Game

With our learning methods utilizing more online resources, it's only fitting we have an investing simulation game your students can participate in as individuals or in groups. This scenario asks students to have a basic understanding of stocks and how they should invest their money for the greatest lucrative reward.

Learn more: Build Your Stax

12. Scholarship Strategies

There are all types of unique scholarships out there for students to apply for when they are preparing for college. This creative activity provides different descriptions of scholarships for you to give to each of your students. They can read about what they need to do to apply, what to expect, and what the scholarship would provide them.

Learn more: Unique Scholarships

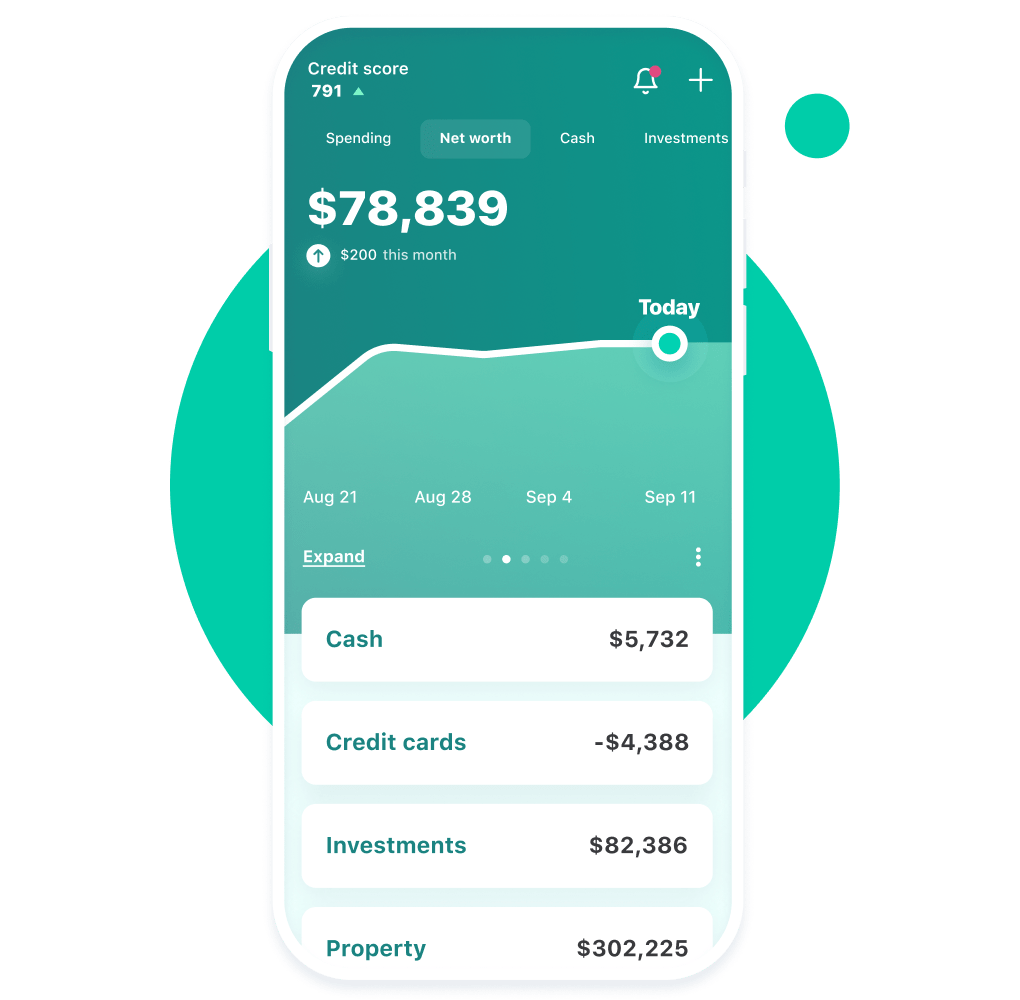

13. Mint App

Encourage your students to download a budget tracking app like Mint so they can input their income/savings, expenses, and other personal financial information, so they won't miss a deadline or overspend.

Learn more: Intuit Mint

14. Acting-Out Identity Fraud

In a digital world where our personal information is being shared and sold to companies all the time, it is important to teach middle school students the dangers of fraud. Play a game where students take on roles and discuss how and what happens when identity theft takes place.

Learn more: Consumer Finance

15. Different Types of Insurance

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)

There are 5 main types of insurance people can purchase. Go through and see what knowledge your students have already about what they cover, why they are important, and how we can make our own educated decisions about what we need.

Learn more: Building Blocks Teacher Guide

16. Matching Game: Insurance Coverage

Do your students understand the risks of not having insurance? Your teenage students are beginning to think about driving, moving out, and eventually having a house of their own. This matching game teaches what insurance policies are right for who depending on their job, expenses, and needs.

Learn more: Building Blocks Teacher Guide

17. Banzai

This free online tool allows students to create an account and have access to games and worksheets, and learn how to manage their money. Teachers can check in on their student's progress as they learn about borrowing money, setting goals, and budgeting for a bright future.

Learn more: Banzai

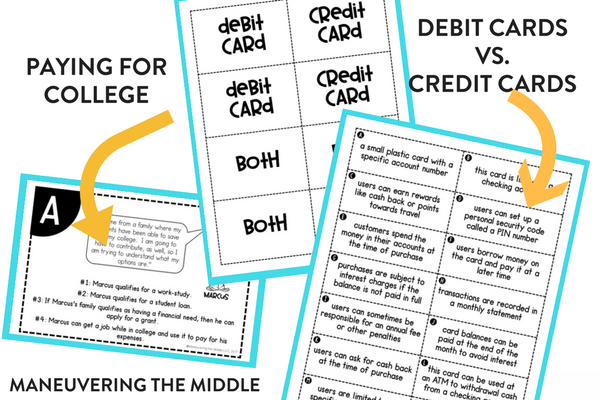

18. Debit vs. Credit Card

This matching game helps students understand how a debit card and credit card use money differently. There are certain risks to a credit card that aren't there when using a debit card. Go over how to use each then see what your students can remember.

Learn more: Maneuvering the Middle

19. Make a Finance Word Wall

There are many new terms students will have to learn to participate in the financial world. Create a fun and engaging vocabulary wall where students can refer to concepts like "lend", "mortgage", and "federal" and see what they mean.

Learn more: Scaffolded Math

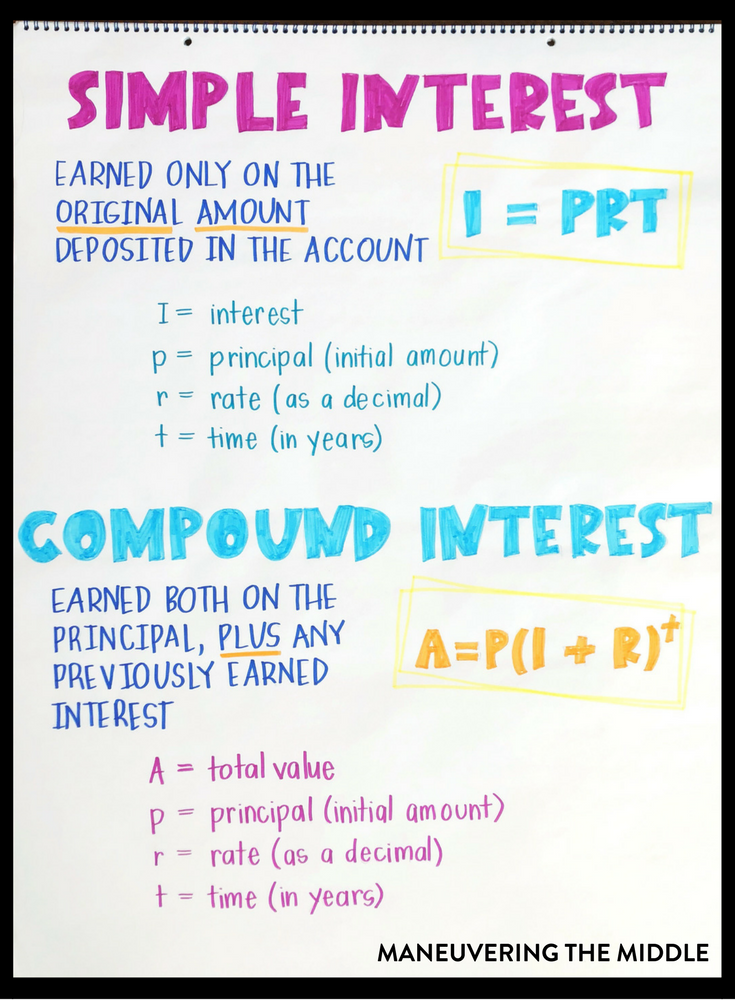

20. Simple vs. Compound Interest Lesson

You can't learn financial literacy without understanding some mathematical concepts necessary for safe investing, borrowing, and saving. Create a chart your students can refer to regarding how interest works and teach them the math equations.

Learn more: Maneuvering the Middle

Source: https://www.teachingexpertise.com/classroom-ideas/financial-literacy-activities-for-middle-school/

Post a Comment for "Easy Inventions to Make in Financial Literacy Class in Warren Middle School"